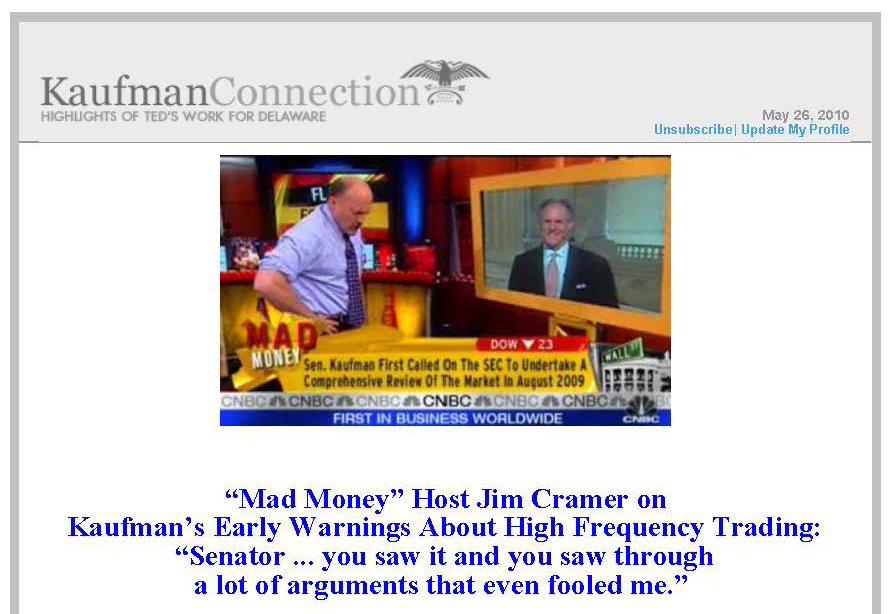

An increasing number of regulators and market participants were urging greater transparency in high frequency trading practices by early 2010; Kaufman asked the SEC to make reducing systemic risk a priority and encouraged high frequency traders to join the discussion. On May 6, 2010, a flash crash caused the Dow to drop 500 points, the single-biggest intra-day decline ever, and Kaufman’s year-long warnings about high frequency trading were vindicated. Following the May 6 crash, Kaufman and Senator Mark Warner (D-VA) proposed an addition to the Dodd-Frank financial reform bill that would require the Securities and Exchange Commission and the Commodity Futures Trading Commission to report to Congress about the causes of the market dive.