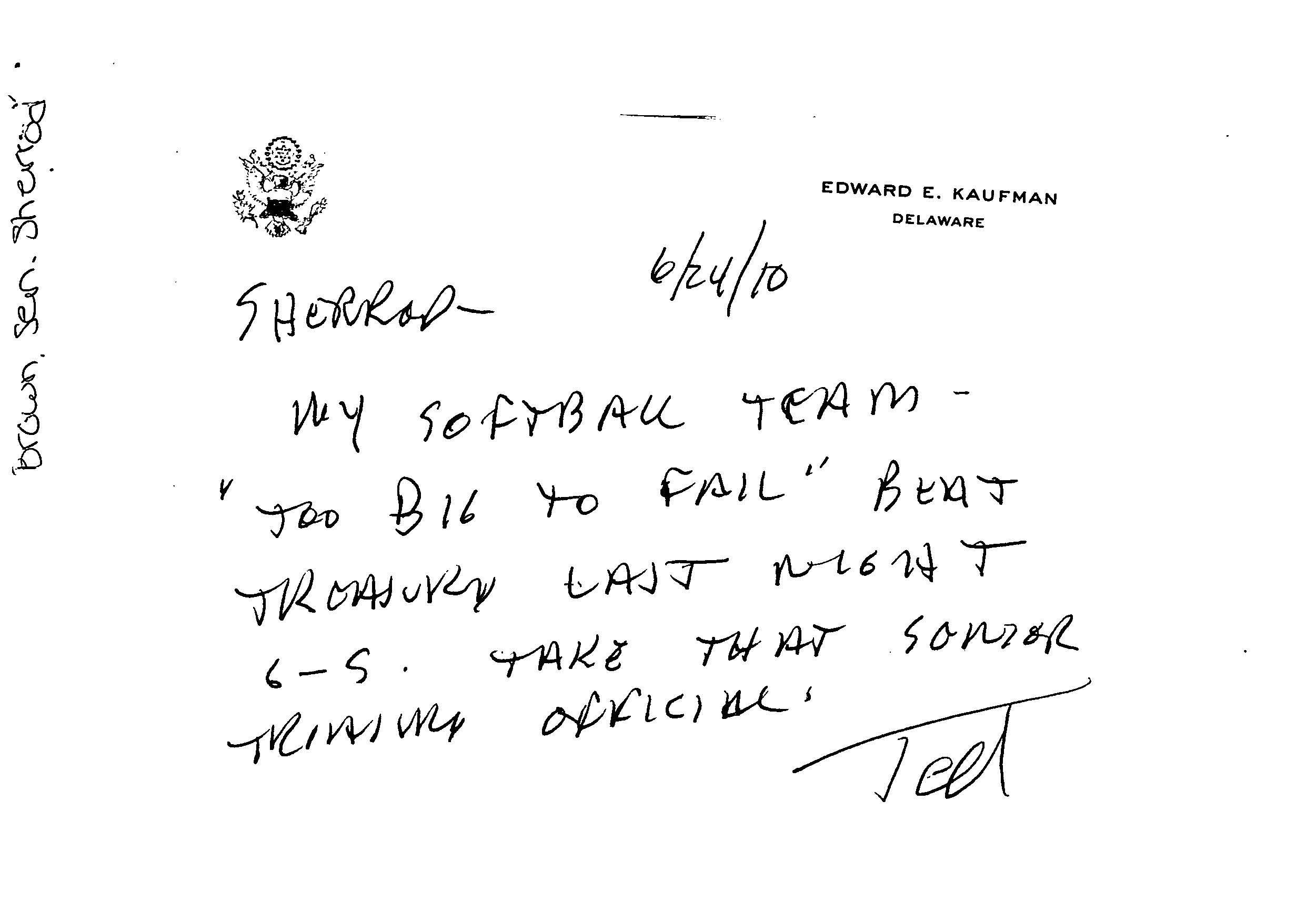

During the financial crisis, financial power was concentrated in just a handful of U.S. banks, and they edged precipitously close to bankruptcy. Many argued that allowing these large financial institutions to fail would cause irreparable devastation to the entire financial and economic system. So in 2008, Congress, the Federal Reserve, and the American taxpayers committed trillions of dollars to saving those institutions, institutions that eventually became known as “too big-to fail” (TBTF). Throughout his term, Senator Kaufman argued that TBTF institutions were too big and interconnected to regulate or manage. Pointing to their potential to contribute to another financial meltdown, Kaufman called for the breakup of these institutions and greater regulation.